How to Save Money in Real Estate with a 1031 Exchange

If you’re thinking about selling an investment property and want to avoid a big tax bill, you might want to consider using a 1031 Exchange.

I help my clients use this powerful strategy to reinvest their profits and keep their money working for them instead of handing a chunk over to the IRS.

So what is a 1031 Exchange?

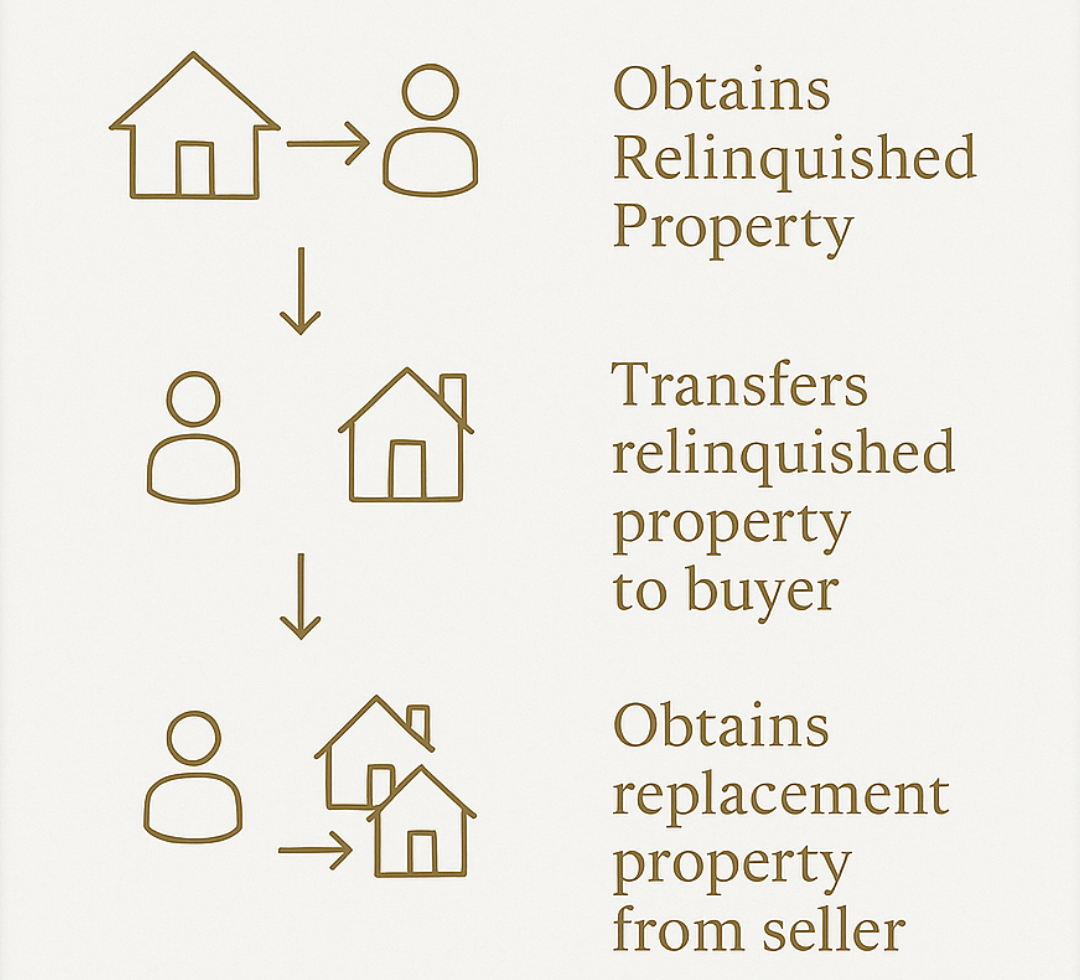

It’s named after Section 1031 of the U.S. tax code and allows you to defer paying capital gains taxes when you sell one investment property—as long as you use the profits to buy another similar (or “like-kind”) property.

The term “like-kind” sounds complicated, but it’s actually pretty flexible.

For example, you can sell a rental house and buy a commercial building, or swap land for a multi-unit property. The catch?

Both properties must be in the U.S. and used for business or investment—not personal homes.

There are a couple of strict deadlines you need to know about:

You have 45 days after selling your property to identify up to three properties you might want to buy.

You have 180 days to close on one of them.

Miss these deadlines, and you could lose the tax benefits.

You’ll also need to work with a Qualified Intermediary (QI)—this is a neutral third party who holds the money from your sale and uses it to buy your next property. You can’t touch the money yourself, or the deal won’t qualify.

One thing to keep in mind: this isn’t a way to avoid taxes forever—it’s a tax deferral. But the great thing is you can keep doing 1031 Exchanges over and over again, deferring taxes as you build your real estate portfolio.

Also, the tax basis from your original property carries over to the new one. That’s important to understand because it affects your future taxes and depreciation write-offs.

This is just a simple breakdown, but it covers the main points I walk my clients through. If you’re thinking about growing your investment portfolio or making a smart move with a property you already own, I’d love to help you navigate the process.

Want to see how a 1031 Exchange could work for you?

Contact me today for a free, no-obligation consultation and let’s explore your options together. Real estate investing is a smart way to build wealth, let’s make sure you keep more of what you earn.